The onset of COVID19 has had a severe human cost and has caused ruptions in markets around the world.

Equity markets are down on average 25% around the world, Irish bank shares are down over 60%, interest rates have been slashed, oil has crashed, gold is soaring and the Property market is in pause mode.

Despite restrictions being extended until the 5th of May, we are starting to see some positive signs; infection rates are slowing and parts of continental Europe are starting to come out of lockdown.

For some investors, turbulent times cause them to put their investments on hold, while others see great investment opportunities and adjust their strategies to take advantage.

At the inception of Property Bridges we had two main goals:-

- Increase the supply of housing by providing small to medium-sized developers with access to funding.

- Provide investors with an alternative way to invest in the property market that is hassle-free.

Those goals have not changed.

As some international investors pull back from the Irish construction market, we believe it will be a time of opportunity for Irish investors to invest in local real estate.

We very much hope that over the last 18 months we have given our investors an alternative to the stock market and allowed lenders to diversify their portfolios. We continue to believe that direct lending with physical assets as security is a great investment in good times and in bad.

Property Bridges will continue to operate during these tumultuous times, albeit at a lower risk appetite.

Property Market – Long Term Positive, Short Term Brutal

The property market is in pause mode at the moment. Transactions have all but dried up and deals have stalled as the market has been put on hold.

A large part of the value of a home is based on comparables, that is, similar houses in the same area that have recently sold. As transactions have dried up, there is no market and when there is no market it’s hard to get an indication of how prices have been affected.

In a recent CBRE flash call, head of research in Ireland, Marie Hunt, summed the market up as long term positive, short term brutal. She noted that the environment was fundamentally very different to that of 2008 in the sense that usually at this point in a downturn, a key concern would be oversupply but that is not a concern now as the supply pipeline has been very contained over the last couple of years. The shutdown of constructions sites over the period will constrain the pipeline even further.

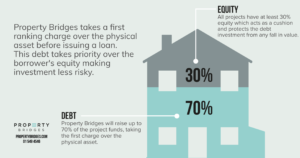

Our Loans & Funding Model Remains Robust

Construction sites have been shut for the last two weeks and the extension till the 5th May will see them close for another 3 weeks. This undoubtedly will have an impact on our loans and it is likely that some of our loans will have to be extended for a 3-month period. We do not foresee any risk of default in any of our current projects and lenders can expect to receive their full rate of return.

We currently have funds deployed on 3 ongoing projects, Mullagh, Monasterboice and Pallaskenry. Property Bridges will not be applying penalty interest on projects that have been delayed by COVID19 so lenders will not receive an enhanced rate of interest for the extended period.

We were delighted that over the last number of weeks, our lenders supported our Pallaskenry project to the tune of €235,000 in record time.

Our partnership with our payment provider Mangopay ensures that in these turbulent times, clients funds are held in a secure escrow account with one of France’s largest financial institutions, Credit Mutuel Arkea. So, users can be rest assured that their money is held securely.

We’re also incredibly proud of the fact that Property Bridges investors have been able to withdraw all undeployed funds within 24 hours. This flexibility differs from many investment schemes that have set redemption windows, meaning investors can only withdraw funds at certain times of the year. Likewise, when the situation lifts, lenders will be able to easily deposit funds back into their e-wallets.

P2P Industry Can Play a Crucial Role in the Current Crisis

The peer to peer industry evolved from the global financial crisis and we believe it will play a crucial role in getting us out of the current one. The p2p model is growing rapidly and helping to add liquidity to the economy in turbulent times.

When the market comes back to life, there are a few potential upsides that will emerge for the P2P industry in Ireland.

- Interest rates have been cut even further and are unlikely to increase in the near future. Therefore, more savers and investors will look to P2P for attractive returns.

- The shutdown of construction sites will have constrained supply even further leading to increased future housing demand.

- It’s encouraging to see other P2P lenders giving two-month payment breaks to all loans in the leisure sector. Likewise, Property Bridges will not be applying penalty interest to loans affected by Covid19. By working with our borrowers, we hope to build up stronger relationships for the future.

- The industry has a real chance to prove itself by surviving an economic downturn and coming out stronger.