How it works

At Property Bridges, transparency and security are our top priorities. We’ve outlined below the 4 simple steps to earning money with Property Bridges.

Simple Sign Up

Step 1

Sign Up

Sign up in less than 2 minutes and then upload a visible and valid copy of your identity proof and proof of address

Step 2

Deposit

Make a deposit into your Property Bridges account using your personal IBAN available in your e-wallet.

Step 3

Invest

Invest confidently in offerings that have undergone meticulous evaluation, ensuring your peace of mind.

Step 4

Repayment

Upon project completion, returns are deposited back into your e-wallet. Investors can choose to reinvest or withdraw their capital.

Testimonials

Property Bridges is very reliable

I’ve always found that Property Bridges is a very reliable finance company in Land/Property development to invest in. It always details its projects very well, regularly communicates with investors on how Developments invested in are proceeding or not proceeding to plan and works hard for its investors, to get everything back on track.

A Big Fan

I have been a fan of investing in Property Bridges since the very first investment opportunity presented itself. I feel very secure in my investments. Repayments of interest & capital are made in a timely manner. Propert Services offers a professional service, communications are open and frequent, and the management is very accessible.

Excellent company to deal with.

I have been investing with property bridges this past few years.They are transparent,easily accesible and great communicators. I have never had an issue with them,they are just professionals .The interest rate they pay to lenders is significantly competitive in comparison to other institutions ,moreso in times of high inflation. I am very pleased with my returns ,in a nutshell ,property bridges are highly commendable.John B

As an investor I’m impressed

As an investor I’m impressed by the level of communication, business generated and the interest rate fairness and social capital provided. An essential element of any portofolio .

Solid diversification option

Have been an investor for few years now: had no issues whatsoever, made good returns so far, no issues in getting the money transferred back to your personal account, good & transparent communications…so I see it as a very good diversification option, especially in situations like the current macroeconomy environment. I find the due diligence process and documentation provided are pretty solid to make a decision on whether it is a good project even without too much knowledge of the industry.

Excellent Investment Option

Been a customer/investor for over a year and propertybridges has been great. I find the website very easy to navigate and use.

I use it to diversify from the stock market and it allows me to invest in property without the hassle of buying one

Most importantly i have always received my capital and interest

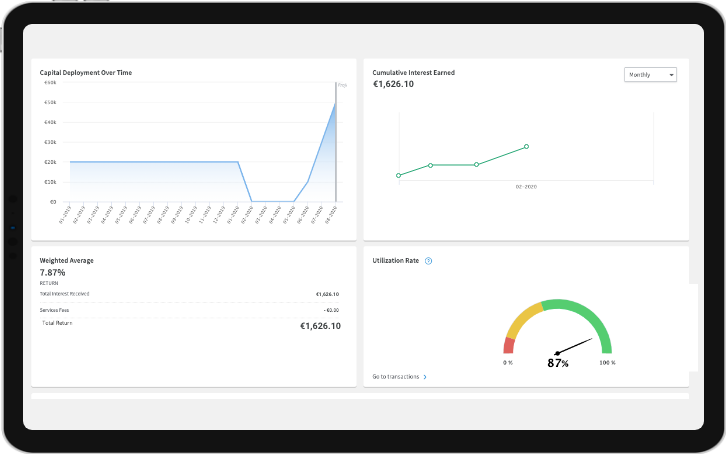

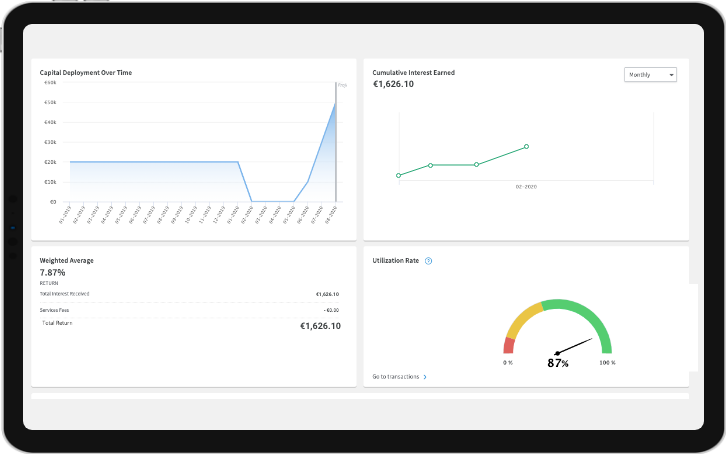

Access Your Dashboard

Easily track your investment progress with our intuitive dashboard. Stay informed about each investment’s progress and performance, and effortlessly visualise your portfolio’s growth.

Utilise our Auto-Invest feature to reinvest your earnings seamlessly, maximizing returns and earning more without any hassle. With Property Bridges, staying in control of your investments is straightforward and user-friendly.

Confidence Through Successful Track Record and Robust Due Diligence

Over the last 6 years, Property Bridges has build long standing relationships with experienced homebuilders. Once approached for funding, our experienced team will undertake a meticulous evaluation and due diligence process. Before any project is showcased on our platform, it will have to have met our strict criteria. We’re committed to presenting only the highest quality opportunities to our investors as has been demonstrated by our successful track record. We will publish a credit paper of all our loan opportunities so our investors can assess whether the projects are suitable for their risk appetite. This transparency empowers our investors to invest confidently in opportunities vetted by experts.

Are you ready to invest?

Find the perfect investment for you and help to build the future with Property Bridges.

(01) 549 4546 | team@propertybridges.com | https://www.propertybridges.com/