In early July the Government, working in partnership with the banking sector, have established a new national shared-equity First Home Scheme. Under this scheme, the State and participating banks will jointly support first-time buyers on moderate incomes to purchase a new build home in a private development until the year 2025. The support will take the form of an equity facility, secured by a second charge on the home equal to the level of funding provided through the scheme.

Why only new builds in private developments?

With this scheme the government aims to improve access to and the affordability of new homes for people on moderate incomes and also to stimulate an increase in supply of new homes by improving confidence in the viability of future housing developments to meet increased, realisable demand. Additionally, the government anticipates that this scheme will support the economic recovery from COVID-19 by encouraging employment in the construction and related sectors.

Which banks are participating in this scheme?

At the time of writing, there are 3 main banks on-board with this scheme, these are AIB, Bank of Ireland and Permanent TSB and it is anticipated that other lenders will follow suit quite soon.

The Government have announced that from 2022 to 2025 they will be providing €400 million to provide support to 8,000 households to purchase new homes, and this will be the funding which will make this scheme possible.

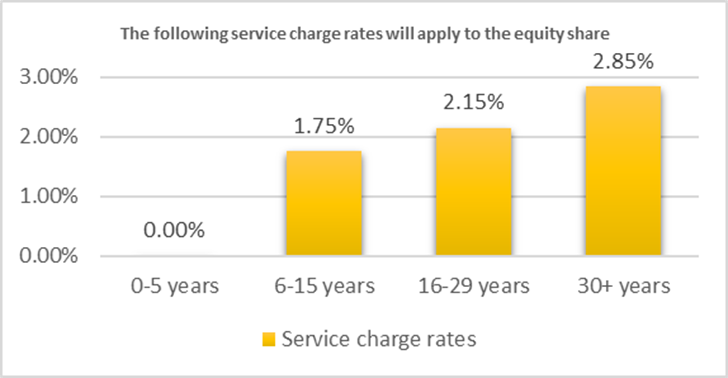

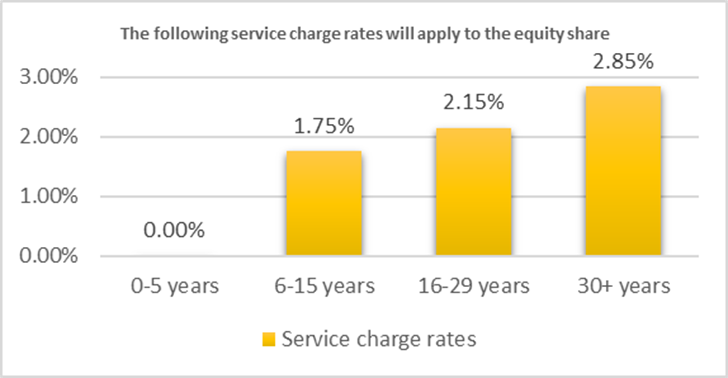

Under this scheme no interest or fees will apply to the equity stake in the first 5 years post purchase and the purchaser will be able to redeem or buy out the State’s equity stake at the time of their choosing, similar to the Local Authority-led Affordable Purchase scheme.

However, there will be no compulsion to do so unless the property is being sold, the property is no longer the purchaser’s principal residence, or in the event of the death of the purchaser. A service charge will apply to the equity stake from Year 6 onwards and will apply until the full equity is redeemed. The service chargebeing simple interest, and not compound.

This chart below displays how the service charge will be applied:

The scheme aims to bridge the funding gap for eligible purchasers between their deposit and mortgage, and the price of a new home sold through the private market and unlike the Local Authority-led Affordable Purchase scheme, the First Home Scheme will be available nationally, and purchasers can themselves determine where they choose to buy.

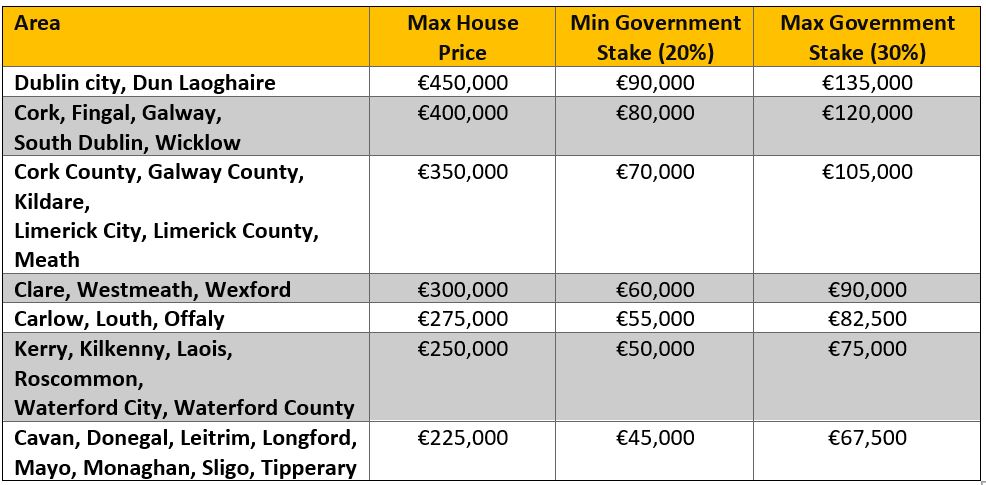

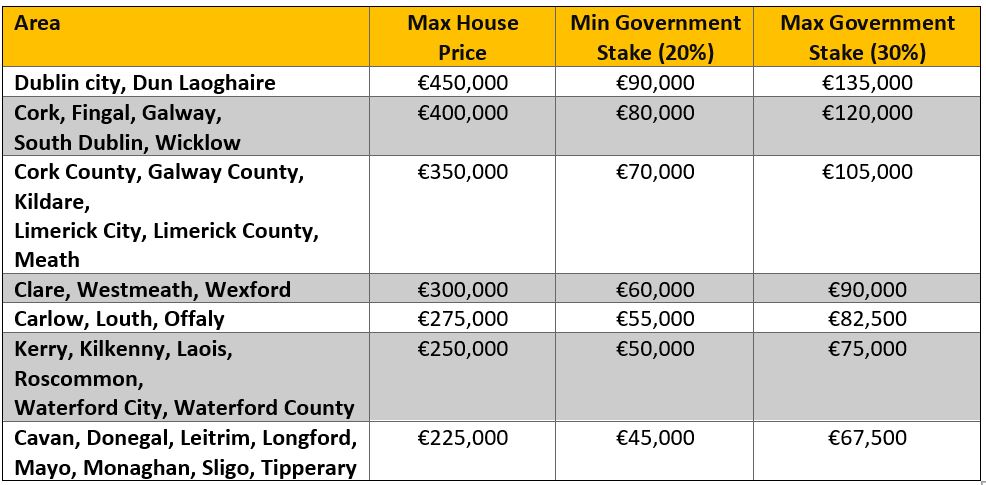

Homes made available will be subject to area-based price ceilings for houses and apartments, meaning that the price caps are decided based on average house prices from Central Statistics Office figures. It is anticipated that these ceilings will range from €225,000 for homes in the most competitively priced areas of the country to €450,000 in the most expensive areas. In exceptional cases, specific ceilings may be applied to simulate the supply of apartments in urban areas.

Up to 20% equity support will be available to purchase these homes (or max 30% if the Help to Buy is not utilised). To explain further, this equity stake will be available to eligible purchasers to bridge the gap between their deposit and mortgage combined, and the cost of the home they want to buy. The mortgage applied for must be the largest mortgage that can be qualified for, 3 and a half times annual income, and the funding gap to bridge must be no more than 20%, or 30% if the Help to Buy scheme is not utilised.

Utilising the support of the banking sector to match Exchequer funds in delivering this scheme, will enable the State to double the benefit of its investment for purchasers and support twice as many families and individuals to buy their first homes. This market based scheme will be established immediately, allowing time for the Local Authority new-build delivery to ramp up.

This data below displays the different house price ceilings in different areas around the country, the minimum stake from the Government (20%), and the maximum stake (30%):

What is the desired impact of the scheme?

The First Home scheme, together with other measures such as the Local Authority Affordable Purchase Scheme, the Help-to-Buy incentive and the Local Authority Home Loan will make home ownership achievable for tens of thousands of individuals and families in the short- and medium-term. As the participating banks will match State funds, the First Home scheme will be able to help twice as many families and individuals buy their first homes.

How will this scheme impact developers?

With this scheme the Government wishes to improve confidence in the viability of future housing developments in order to meet increased, realisable demand for housing. The scheme in itself will cause an increase in demand for housing, given that first-time buyers now having more purchasing power with the financial support of an equity stake from the government. So long as there are no skilled labour shortages or land development frictions that would impede on development, developers can benefit greatly from this rise in demand for new homes.

Although one potential concern for developers is the amount of red tape surrounding this scheme. However, only time will tell if the scheme will be more hassle than it is worth for developers, but it would seem to be in the best interest of the Government to make the process as seamless as possible.

The First Home scheme is anticipated to be introduced in early July.

Upon launch first-time buyers can apply at: www.gov.ie/housingforall

For more information on new plans from Housing for All see: Housing for All.pdf