Property Bridges Market Update – June 2023

Conclusion: Activity is Down on 2022 but Waiver Of Levies is Having a Positive Impact on SME Homebuilders

State of the market

As I write this state of the market update on the 12th of June 2023, the ECB has raised interest rates at record-breaking speeds over the past 12 months in an attempt to curb inflation. While inflation is coming down, it’s not coming down as fast as previously hoped. The policy shift has led to increased strains across the markets most notably in the US regional banks. Many commentators are concerned about the exposure these banks have to commercial property assets in the US. Commercial property owners have suffered a double blow with the working-from-home trend compounded with increased interest rates.

While all these headwinds are real, Property Bridges operates in a small subsection of the property market and are focused primarily on residential housing and development in Ireland. While the industry faces similar challenges, the fundamentals behind residential property and residential property development in Ireland are still strong.

As larger institutions pull back there is a real opportunity for alternative lenders like Property Bridges to step in and benefit.

Sluggish Activity

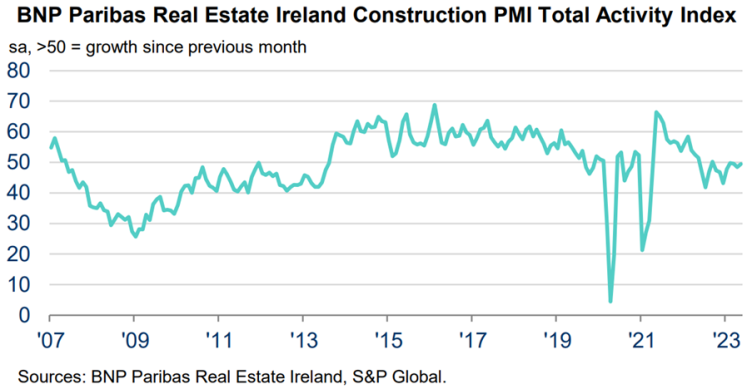

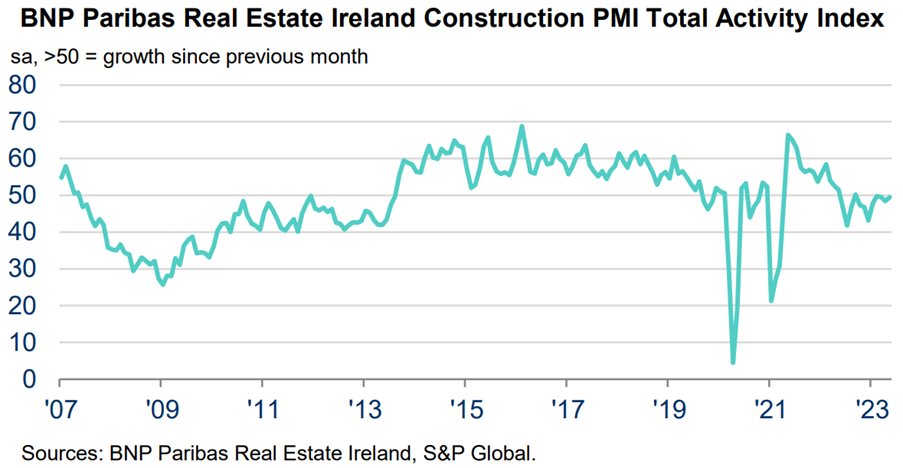

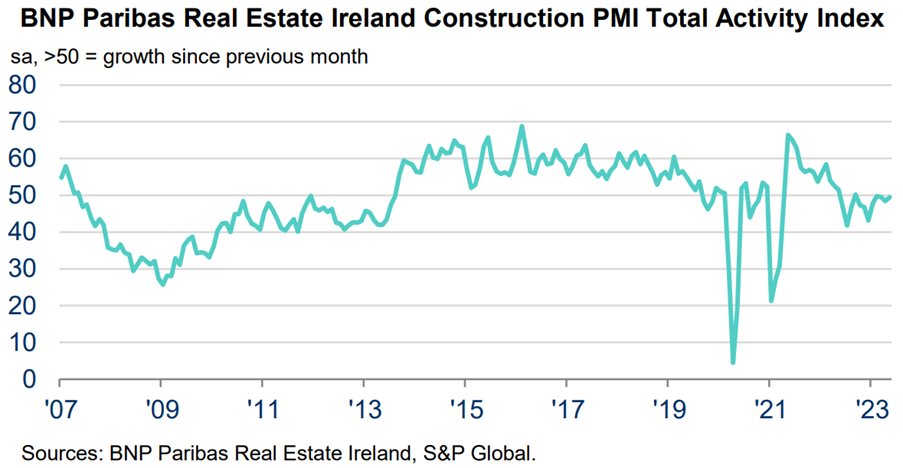

According to the BNP Paribas Real Estate Purchasing Managers Index (PMI) residential building continued to decline in May. 636aa6e5a8594a9e8a6b6ddfcf45e7be (spglobal.com)

However, the rate of decline is slowing and there are some positives. The report lists that there were uplifts in new orders, employment and buying activity.

Property Bridges operates in a small subsection of the overall real estate market. We primarily serve, small to medium-sized homebuilders and property investors across the country.

Our data would suggest the same, the number of enquiries we received from SME developers between Jan-May this year dropped by 29% on the same period in 2022.

Viability Issues

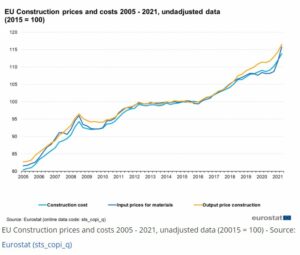

The biggest issue we see for SME developers is the viability of projects as profit margins keep getting squeezed. Pre-Covid and during Covid, margins on construction projects were already tight, but since 2021 we have seen consistent build cost inflation. This has been compounded by rising interest rates which not only increase the cost of lending but also squeeze the purchaser as mortgage repayments are impacted.

Lenders may have noticed that Property Bridges originated more income-generating and conversion opportunities to our lenders so far in 2023. This has been due to the fact that many development projects have been marginal and did not meet our profitability threshold.

Waiving of Levies

What’s not widely reported when it comes to the cost of delivering new build property, is the amount of money that’s transferred from first-time buyers to the government in the form of taxes, levies and utility costs.

Over the last few years, the government has announced incentive schemes for first-time buyers which have had a positive impact. They were yet to address the cost of supply until recently.

The government has recently announced a suspension of development levies for 12 months and rebates on utility costs. This has had a material impact on the viability of some housing schemes and we are seeing that in terms of new business enquiries for funding. It is encouraging to see the government take such measures and this will go some way to boost supply. We would encourage the government to look at further measures such as reductions to the VAT on new builds.

Given these recent announcements, Property Bridges lenders will see new development opportunities become available in the second half of the year.

House Prices Remain Robust

House prices remain robust, Dublin agent Owen Reilly has reported a strong May with average selling prices 8% over asking. They note ‘ Earlier this year the CSO reported Dublin house prices had fallen marginally in the first three months. This data would have been based on transactions at the end of last year. We assume later this year data from the CSO will confirm what we are seeing on the ground since January: strong demand, strong selling prices and an increase in prices despite rising interest rates’.

Property Bridges are witnessing the same thing on the projects we are funding. Many of the homes are selling for more than originally forecast during the initial assessment of projects and homes that are up for sale are selling quickly. This has helped to alleviate the cost inflation discussed earlier.

Economy

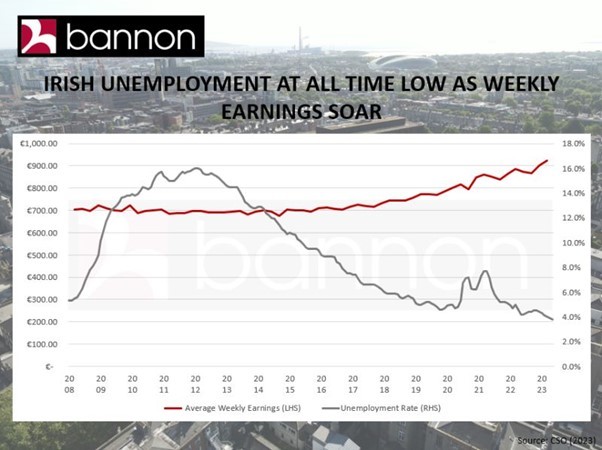

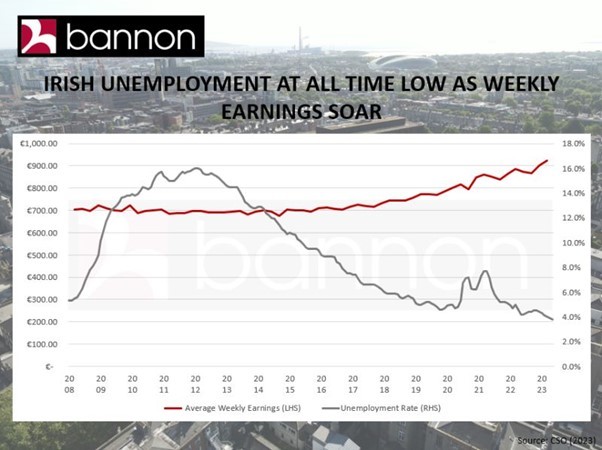

The data from the economy is coming in at much stronger levels than predicted. Despite interest rate rises, unemployment is at a record low of 3.8% and weekly earnings are at a new high.

Conclusion

In conclusion, Property Bridges are cognisant of the viability issues that remain in residential housing development and have adjusted our investment appetite accordingly. The new government measures are a material help and will improve the viability of some projects.

The pullback of larger funding institutions will provide opportunities for Property Bridges and other alternative lenders and we will start to see new types of projects. As interest rates are rising across the board, it also means that Property Bridges can offer our investors higher returns on their capital.

We always encourage our investors to do their own research and not to take our comments as investment advice.